Hunter Biden Pleads Guilty to Tax Charges, Avoiding Trial and Potential Embarrassment

A Deeper Dive into the Case and Its Implications

Introduction

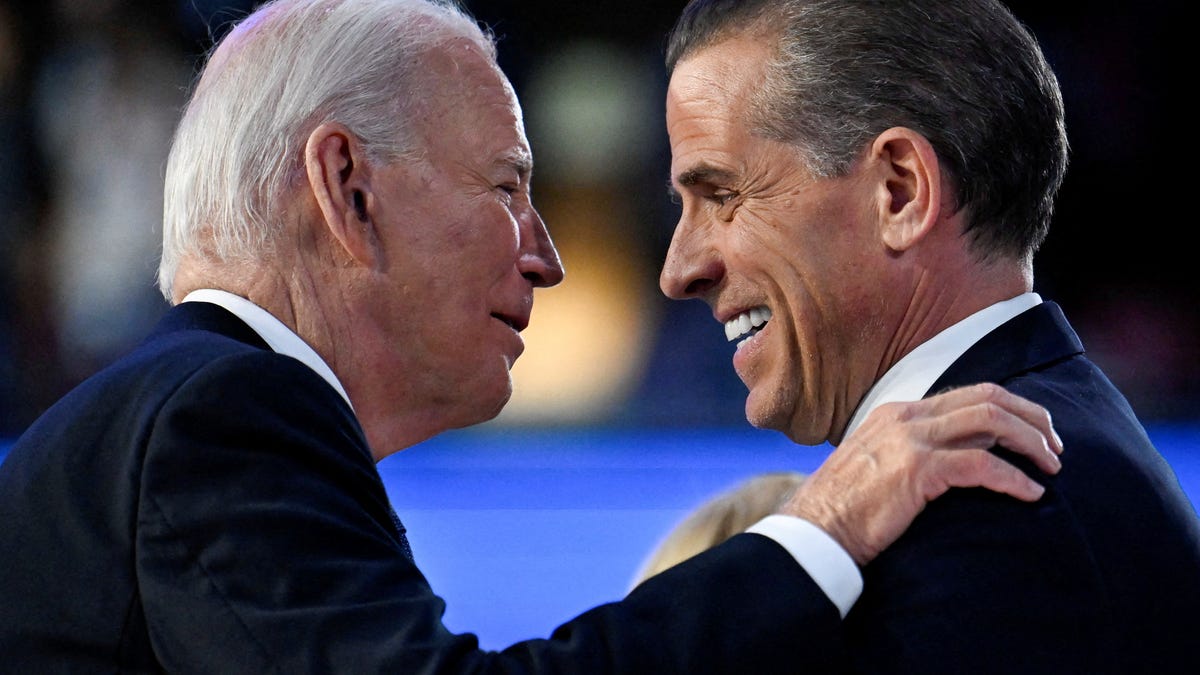

In an abrupt turn of events, Hunter Biden, son of President Joe Biden, pleaded guilty to all nine federal tax charges against him. This move came unexpectedly on the day jury selection for his trial was scheduled to commence. By entering a guilty plea, Biden evaded the potential scrutiny of a trial that would have delved into a challenging period of his life marked by addiction.

Details of the Charges and Biden’s Plea

The charges against Biden stemmed from his failure to pay $1.4 million in taxes from 2016 to 2019. Initially, Biden sought to plead guilty under an Alford plea, where he acknowledged that the prosecution had sufficient evidence to convict him but did not admit wrongdoing. However, this was opposed by the prosecution, who insisted on an admission of guilt. Ultimately, Biden pleaded guilty to three felonies and six misdemeanors.

Biden’s Statement and Explanation

In a statement released after his guilty plea, Biden acknowledged his failure to pay taxes on time and accepted responsibility for his actions. He also alluded to his struggles with addiction during the relevant period, stating that it was “not an excuse, but it is an explanation for some of [his] failures.” Biden emphasized that he had paid all back taxes and penalties and expressed his desire to avoid further pain and embarrassment for his family.

Sentencing and Potential Consequences

U.S. District Judge Mark Scarsi scheduled Biden’s sentencing for December 16th. The tax charges carry a maximum sentence of 17 years, though it is likely that Biden’s sentence will be lower. Additionally, Biden previously faced three federal gun charges for lying about his drug use when purchasing a handgun in 2018. These charges carry a maximum sentence of 25 years.

Behind-the-Scenes Negotiations and Failed Plea Deal

Prior to the guilty plea, Biden’s legal team had negotiated a plea agreement that would have resolved both the tax and gun charges. However, this deal was rejected by federal judge Maryellen Noreika due to disagreements between prosecutors and defense attorneys regarding potential future charges. Republicans criticized the proposed plea deal as overly lenient, labelling it a “sweetheart deal.”

President Biden’s Response and Lack of Pardon

President Joe Biden has repeatedly stated that he will not pardon his son. White House press secretary Karine Jean-Pierre reaffirmed this position after Hunter Biden’s guilty plea.

Legal Implications and Scrutiny

Hunter Biden’s guilty plea and the surrounding circumstances have drawn significant attention. Some legal experts have questioned whether the plea could open the door to future charges, including perjury or obstruction of justice. Additionally, the plea may fuel ongoing political debate and scrutiny of the Biden family’s dealings.

Public Perception and Impact on the President

The case has also raised questions about public perception of the Biden family and the potential impact on the President’s reputation. Some political adversaries and conservative media outlets have sought to use the situation to criticize the President and his administration.

Conclusion

Hunter Biden’s guilty plea to tax charges has brought closure to a significant legal battle, potentially shielding him from further embarrassment and avoiding a trial that could have brought his past struggles into the public eye. While the plea may not fully resolve the legal challenges he faces, it marks a significant development in the ongoing saga surrounding the Biden family. The case continues to serve as a focal point for political debate and scrutiny, highlighting the complexities of family, addiction, and the intersection of personal and public life.